“Total crypto market cap is $1.56T…Bitcoin dominance is 59%, which represents a +0.82% gain over the last 24 hours.” — Nomics

When it comes to cryptocurrency, people always think of Bitcoin. In the mainstream financial news, most of what you hear is the rise and fall of Bitcoin. After the clickbait link was clicked in, the article only contained a few concise words. In the crypto world, bigwigs talk about Ethereum, Binance Chain, Huobi, Polkadot, defi, and NFT, but few people talk about Bitcoin. On the one hand, everyone recognizes that Bitcoin is the cornerstone of the entire cryptocurrency world. On the other hand, they talk a lot about the technological superiority of their projects and the reasonable token economy.

However, like the stock market, there are a few “demon shares” with continuous limits every year. But the truth is that investors looking for “demon stocks” should buy lottery tickets. Ordinary investors and fund managers should not count on such investments. If my fund manager someday shows off to me which “demon stock” he has staked on, then I’m sorry, I don’t need a fund manager who is too gambled.

The reality of this blockchain world may be: Just like the market as individual stocks, the price of Bitcoin also has a considerable influence on other cryptocurrencies.

Cryptocurrency follow

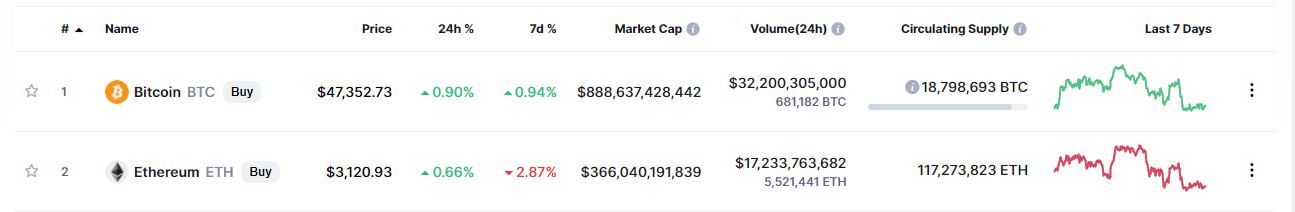

The currency market is the same as other financial markets daily, with ups and downs. When you’ve sung your part, I take the stage. However, just by looking at the chart of the last 7 days, it can be seen that the price trend of Ethereum and Bitcoin are almost exactly the same.

This is not difficult to understand. If Bitcoin is version 1.0 of cryptocurrency, Ethereum is undoubtedly version 2.0 of cryptocurrency. Such an “intimate” relationship is enough to make them both prosperous and ruinous.

What about other cryptocurrencies?

Some of them are “brothers and sisters” competing with Ethereum, and some are applications attached to their respective main chains. Some of them are separated from Bitcoin by a “generation” and will they still advance and retreat with Bitcoin?

The answer may not be so obvious.

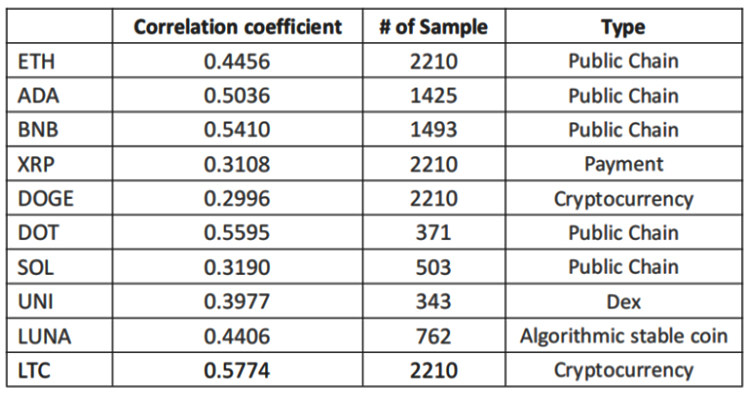

Here, we used the 10 cryptocurrencies with the largest liquid market capitalization on CMC. (Note: non-stable coins are not anchored coins) Pearson correlation calculations are carried out using their daily price rises and falls and Bitcoin’s rises and falls.

The results are as follows:

Correlation coefficient table with Bitcoin

(Statistical time is from August 8, 2015/project listing date to August 26, 21)

(Correlation coefficient: In general, the absolute value of 0-0.09 is no correlation, 0.1-0.3 is weak correlation, 0.3-0.5 is medium correlation, and 0.5-1.0 is strong correlation.)

In fact, the relevance to Bitcoin is still determined by the type of token. The correlation between each public chain and Bitcoin is very high, while the correlation between each application is relatively low.

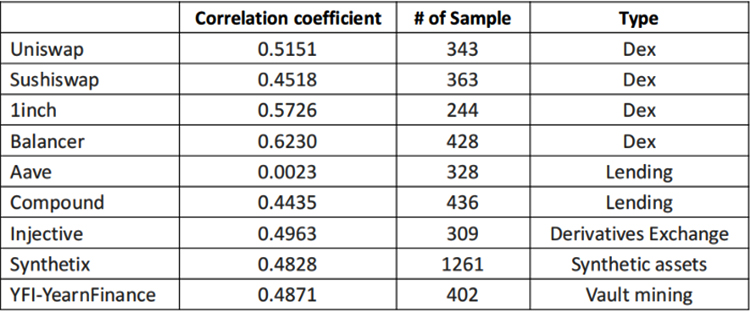

In previous research, we saw that the correlation between Uni and Bitcoin (0.3977) is actually not high. So, as a DEX project on Ethereum, will it be more relevant to Ethereum? If we go one step further, how are other mainstream projects on Ethereum related to Ethereum?

Table of correlation coefficients between popular projects on the Ethereum chain and Ethereum

(Statistical time is from the listing of each project to August 26, 2021)

Now we know at least two main points:

1.Uni and Ethereum are more relevant than it is with Bitcoin;

2.Generally speaking, although Ethereum projects show a certain correlation with Ethereum, The correlation coefficient is still not as good as the correlation coefficients of major public chains to Bitcoin.

Moreover, considering that correlation research is more sensitive to the number of samples, the smaller the number of samples, the stronger the correlation (even if there are only 2 samples in the extreme case, the correlation coefficient must be 1). Then, in terms of Bitcoin correlation samples with thousands of samples, the actual Ethereum project has a lower correlation with Ethereum.

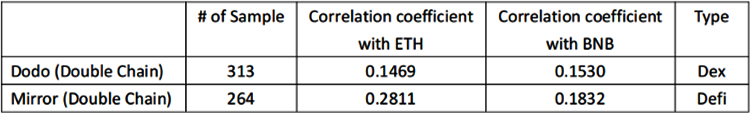

Finally, some projects still “stepped on two boats”. Here we have found two projects that are both alive on Ethereum and Binance Chain. Let’s study how they are related in a slightly more complicated situation.

Table of correlation coefficients between double-chain projects and public chains

(Statistical time is from the listing of the project to August 26, 2021)

There are still some connections between the project and the public chain, every project has its preferences at this time. Dodo prefers Binance, while Mirror prefers Ethereum.

From Bitcoin to major public chains, from major public chains to various projects on the chain, from various projects on the chain to the development of cross-chain products. From simple to complex, we have seen a weakening of relevance. Perhaps, this encrypted world is the same as the real world, the top-level architecture is always similar, but the lives of each person in it are different.

Our research does not intend to stop there. Correlation does not mean cause and effect. Perhaps Bitcoin has affected the prices of other tokens, or vice versa. It is also possible that some factors have affected all cryptocurrencies including Bitcoin. Or, there will be some unexpected changes in this magical field.

To be continued…