Brief introduction about who are we?

PRINCIPLE68 CAPITAL has a world-class investment in R&D and management teams, located in London and Shanghai. Our team members have worked in well-known hedge fund management companies in London. They have rich market experience in computer quantitative model design, research and development, and application. We have several strategies to operate in the cryptocurrency field, namely, statistical arbitrage strategy and intraday trend strategy.

Crypto Systematic Trading Fund

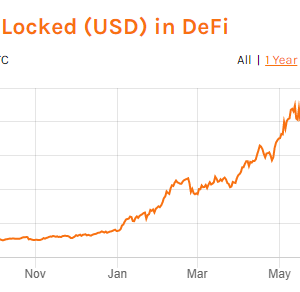

There 3 kinds of crypto systematic trading fund we use.

The first one is trend tracking, we use a large number of different technical indicators to find current market trends, and make directional investments based on the trend. The strategy is intraday high frequency, and the position is managed according to the strength of the trend signal. The strategy can be long or short, and it can be profitable whether in a bull market or a bear market.

The second one is statistical arbitrage. The strategy finds the most relevant currencies, and then finds the long-term equilibrium relationship (cointegration relationship) of each pair of currencies. When the spread of a pair of currencies (residual error of the cointegration equation) deviates to Start building a position at a certain level—buy a relatively undervalued currency and wait until the price difference returns to equilibrium to close the position to make a profit.

The third one is futures spot arbitrage. Futures arbitrage refers to a certain type of futures contract. When there is a price gap between the futures market and the spot market, it takes advantage of the price gap between the two markets to buy low and sell high for profit. In theory, the futures price is the future price of the commodity, and the spot price is the current price of the commodity. According to the same price theory in economics, the difference between the two is the “basis” (basis = spot price-futures price). Equal to the holding cost of the commodity. Once the basis deviation and the cost of holding are large, there is an opportunity for cash arbitrage.

Advantages

Compared with the subjective investment strategy in the market, we have the following advantages. Firstly, from the test aspect, we have real-time analysis and testing capabilities for big data integration in the cryptocurrency market. Also, the system will conduct rigorous testing on massive price data within a valid period, including scenario analysis and stress testing. Secondly, all the decision are relatively subjective. Objective screening process and efficient and stable investment process to avoid human prejudice and emotion. Besides, the model is built in a complete system and does not depend on individuals. Lastly, our risk control system is sophisticated. Our risk management is completely embedded in the entire investment process, not just ex post risk control. What’s more, a wide range of investment strategy applications, 360-degree full market scanning, to avoid the limitation of choice caused by lack of energy. Also, the investment process can be monitored with high transparency, and can be continuously improved and optimized.