In our opinion, compared with the following three things, the bull-bear transition may only have a phased significance in the first half of 2021. The occurrence and impact of these three events will even more represent a milestone in the development of blockchain. They are, respectively:

The rise of Defi and NFT; the global migration of computing power centers; and the Ethereum 2.0 process.

(1)Defi and NFT:

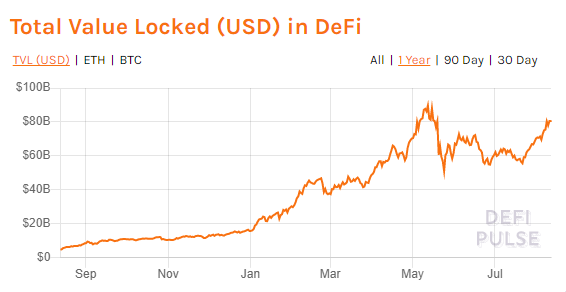

In fact, the rise of Defi should strictly be counted from the second half of 2019, but this trend continued in the first half of this year. According to the statistics of DefiPulse, Defi’s lock-up volume increased from $15.87B on January 1, 2021 to $77.97B on August 12, an increase of 387%.

Exhibit 1: Defi’s lock-up amount from September 2020 to present

Source: DEFI PULSE

Exhibit 2: 2020.1-2021.6 NFT sales on OpenSea

Source: opensea.io,cryptoart.io,Dune Analytics

But the rise of NFT is really the new format this year. Compared with traditional tokens, NFT is indeed a big improvement, especially in the popularization and application level of blockchain. According to a report from Reuters on July 5, NFT achieved an order of magnitude increase in the first half of 2021.

(2)Migration of computing power:

Blockchain has been a global industry since its inception. Therefore, from a global perspective and the development of the blockchain, the migration of computing power will be the norm for the blockchain, and the decentralization formed by the dispersion in the migration process is beneficial to the healthy development of the system.

Although China’s regulation in the first half of the year seems to be the main reason for the migration of computing power. However, CCAF’s statistics show that, in fact, the migration has already begun even earlier, and it is becoming more and more decentralized, which is more and more conducive to the stable development of the Bitcoin system.

Exhibit 3: The proportion of countries accounting for the Bitcoin computing power of CCAF, the Cambridge Derivative Finance Center (2019.10-2021.4)

Source: CCAF statistics

(3)Ethereum 2.0 process

If Bitcoin is the spiritual pillar of the blockchain world, then Ethereum is the guarantee for the rapid progress of the blockchain. So this is why the entire industry is paying attention to the upgrade of Ethereum from 1.0 to 2.0. From POW to POS, it has been conceived for a long time, discussed for a long time, and still pending for a long time.

April 15, the Berlin fork disappointed the entire crypto world because there was still no consensus on important changes. It was not until the London fork on August 5 that EIP-1559, a change that changed the charging model of the Ethereum chain, was finally launched. The launch of EIP-1559 marks another step forward in the progress of ETH2.0.

In the Ethereum community, the indicated time point for the completion of 2.0 has always been: about 2022. We previously expected it to be at the end of 2022, but for now, we need to move ahead.

Blockchain + industry

As shown in the 2019 McKinsey report, the blockchain is at a critical point from the development stage to the growth stage. The next 10 years will be the 10 years when the blockchain releases value. The 2020 new crown epidemic is undoubtedly a booster for digital transformation. Companies want to use digitization to improve collaboration efficiency. The application of blockchain in the industry will also enter the fast lane. More fields will join the blockchain ecology, such as blockchain + live broadcast industry, blockchain + agricultural industry, Blockchain + medical industry.

The following will list several hot application areas of the future blockchain.

Blockchain + finance: The application of blockchain + finance has a high degree of maturity. Blockchain technology can be deeply applied to the financial industry supply chain finance, trade financing, capital management, payment and settlement, digital assets, extended fields and other links. Provide credible platform services in pledge, financing, project management and other links.

US payment giant VISA launched the blockchain-based cross-border payment network “B2B Connect” to facilitate cross-border payments by international financial institutions.

Blockchain + Intellectual Property: Blockchain timestamp, hash algorithm, asymmetric encryption and other technologies can effectively solve the problem of copyright confirmation, and blockchain smart contracts and consensus mechanisms can effectively assist multi-person collaboration in intellectual property rights. Consensus judgment and other links.

Blockchain + social: The application of blockchain technology in the social industry can be divided into instant messaging projects and social platform projects; instant messaging projects are simple to operate and have strong security; social platform project rewards and review mechanisms are relatively sound.

Blockchain + Energy: Blockchain can effectively improve indicators such as energy industry distribution and sharing, security and transparency, and promote transparency in multi-party transactions; global blockchain companies have established in-depth applications around distributed transactions, energy finance, carbon trading and other scenarios.

Blockchain + medical treatment: Blockchain can effectively solve the pain points of efficiency, sharing, management, platform and finance in the medical industry, build a complete technical framework, and efficiently apply to scenarios such as data encryption, traceability, and asset digitization.

With the gradual close integration of the blockchain and various industries, the economic benefits brought by the blockchain continue to increase, and it is expected that more companies and users will recognize the blockchain and increase the consensus on the value of the blockchain. Gradually deepen.

Attitudes towards blockchain

Texas, United States: The House of Representatives unanimously passed a “virtual currency bill” that recognizes the legal status of cryptocurrencies; the governor believes that “blockchain is a booming industry that Texas needs to participate in.”

Colorado, USA: A new state bill in the Senate proposes to use blockchain technology to protect private data from cyberattacks and solve the state’s existing data collection and retention problems.

Wyoming, USA: Decided to exempt property taxes on cryptocurrencies in this state. The bill defines “virtual currency” as a form of digital expression that serves as a medium of exchange, unit of account, or means of storage of value, and is not recognized as legal tender by the U.S. government. It aims to simplify the legal framework of cryptocurrency and the use of blockchain technology in the state to facilitate the establishment of related commercial venture capital.

Arizona, USA: Revise the bill that allows residents of this state to use cryptocurrency to pay taxes and fees; incorporate blockchain signature and smart contract technology into the law.

Washington and New Hampshire, USA: The bill on the cryptocurrency ecosystem has been passed.

Delaware, USA: Believing that blockchain will play a broader role in its economy.

Illinois, USA: Using distributed ledger technology to “redefine the relationship between government and citizens.”

El Salvador: Starting from September 7th, Bitcoin will be used as the country’s legal tender.

Busan, South Korea: The head of the digitalization work at Busan Bank stated that “the government is changing its attitude towards cryptocurrency and has appointed a government agency to manage the industry”.

Goldman Sachs: A survey conducted by Goldman Sachs found that nearly half of its family office clients would like to add cryptocurrencies to their portfolios.

Tesla: In February announced the purchase of $1.5 billion worth of bitcoins, a total of 46,000 bitcoins were bought. Tesla CEO Elon Musk made it clear that “Tesla is very likely to resume Bitcoin payments” and revealed that another company, Space X, also holds Bitcoin.

Audi: Announced the release of NFT in cooperation with xNFT and others on August 10.

Ernst & Young: Ernst & Young is one of the first companies to explore the field of cryptocurrency and is committed to the development of the Baseline protocol, which uses the Ethereum public mainnet as a tamper-resistant state machine to record business data. In May 2019, Ernst & Young announced its Nightfall open source code for private transactions on the Ethereum blockchain.

PayPal: Announced the launch of a new service that supports cryptocurrency from the beginning of 2021; in November 2020, PayPal’s cryptocurrency transaction and payment platform for US users will be launched.

Microsoft: Microsoft provides blockchain services through its cloud computing platform Azure; it announced a partnership with Ernst & Young to use the Ethereum blockchain to pay Xbox game royalties.

In the end:

We cannot predict the future.

The British workers described by Marx seem to be living in such a hot water, but the Victorian England is the pinnacle of the British Empire. Both historically and the bottom people of many other countries in the world at the same time, they seem to be happiness.

A generation of Americans who grew up during the Great Depression showed little interest in stock market investment, but their generation was one of the most golden periods in the U.S. stock market.

But under the current trend, the blockchain has passed its born period. The ensuing supervision and questioning are like growing pains.

Young parents are always planning their children’s future, but whose future is really planned? Life is full of accidents, we are just gardeners, watering and irrigating, and expecting it to thrive.

Just like the blockchain.